The Complete Guide to ESOPs and Perquisite Taxation in India: All-New Perquisite Tax Calculator

TL;DR: ESOPs are powerful incentives for employees but come with intricate tax implications at two stages - exercise of options and sale of shares. Here's an intuitive guide on ESOP taxation and a unique tool, the Perquisite Tax Calculator, to help you effortlessly handle these tax computations.

Employee Stock Option Plans (ESOPs) are increasingly becoming an integral part of compensation packages in the corporate world, particularly in startups. They not only offer employees a slice of the company's success but also often result in substantial financial gains. However, these benefits are not without their tax liabilities.

Decoding ESOP Taxation

At the Exercise Stage: When you exercise your vested options, converting them into shares, you're liable to pay tax. The difference between the Fair Market Value (FMV) of the shares on the exercise day and the exercise price you pay is considered your income as a 'perquisite.' This amount is subject to Tax Deducted at Source (TDS) by your employer.

Here's the formula to calculate the perquisite value:

Perquisite Value = (FMV per Share - Exercise Price per Share) * Number of Shares Exercised

For instance, if you were granted 5000 shares at an exercise price of $10 per share, and on the day of exercise the FMV is $20, your perquisite value would be ($20 - $10) * 5000 = $50,000. This amount is considered as a part of your income and subject to tax deductions.

At the Sale Stage: The profit made when you sell these shares in the market is considered 'capital gains.' This profit, subject to Short-term Capital Gains Tax (STCG) or Long-term Capital Gains Tax (LTCG) depending on your holding period, is calculated as the difference between the total sale proceeds and the FMV on the allotment day.

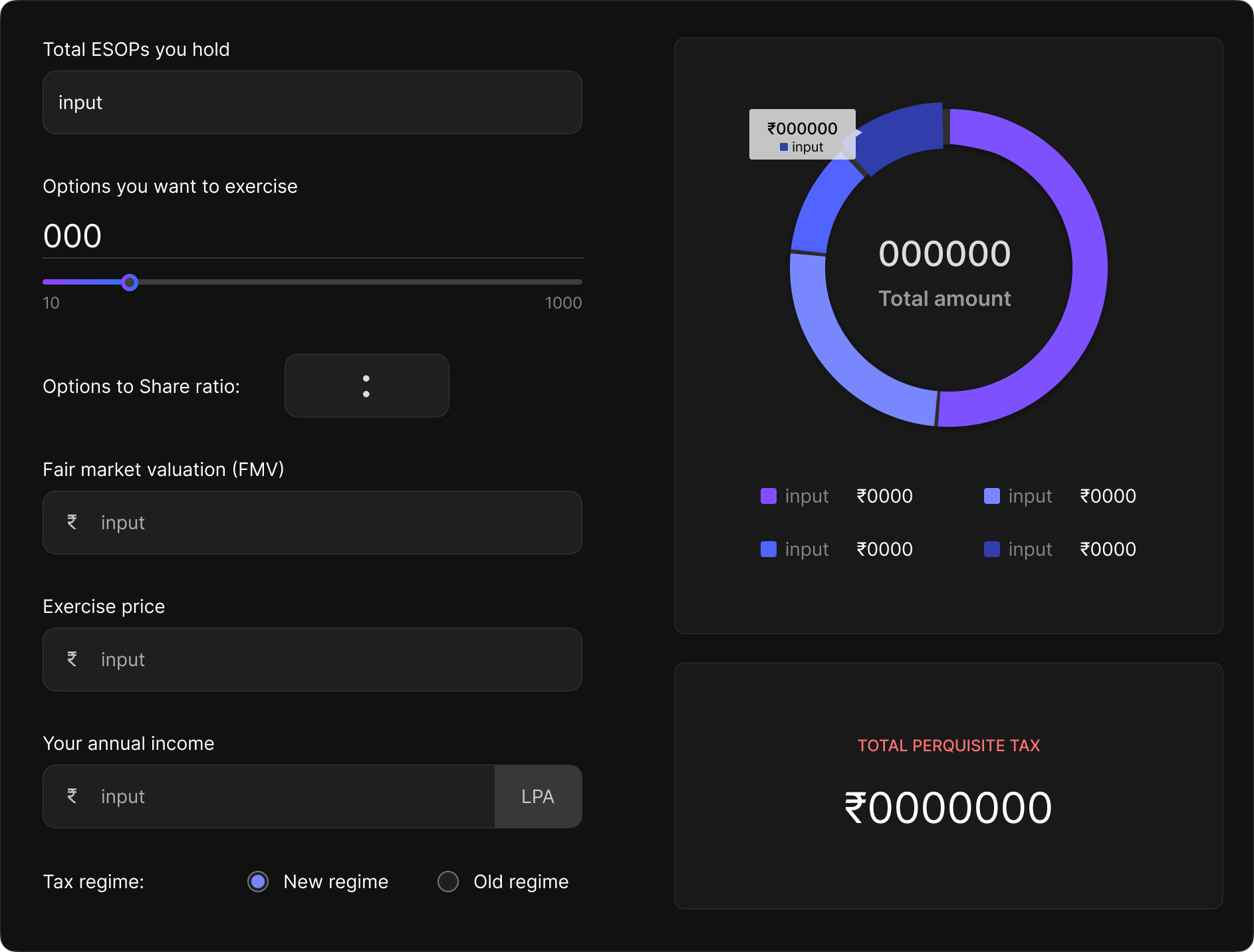

Introducing the Perquisite Tax Calculator

Our Perquisite Tax Calculator is a handy tool designed to assist you in computing the perquisite value and corresponding tax on your ESOPs. With a few simple inputs, this tool provides you with the precise amount of tax you owe.

The Silver Lining for Startups

Notably, recent changes in the Income Tax Act provide a breather to employees of eligible startups. The amendment allows for the deferral of tax payment on ESOP perquisites for up to five years, easing the immediate tax burden and fostering a supportive ESOP ecosystem.

Watch Out for Capital Losses and Foreign ESOPs

There are instances where ESOPs might not be as beneficial, such as a significant drop in share value after tax payment on FMV. If your ESOPs are from a foreign company, you may face additional complexities related to tax jurisdiction and compliance.

To Wrap Up

ESOPs, while lucrative, can be a bit complex when it comes to tax implications. But, armed with the right knowledge and aided by tools like our Perquisite Tax Calculator, you can comfortably navigate through this.

ESOP Taxation Glossary

Employee Stock Option Plan (ESOP): A benefit plan offering employees an ownership interest in their company.

Exercise: The act of buying shares by using the options granted under an ESOP.

Vesting: The process by which an employee accrues non-forfeitable rights over employer-provided stock incentives.

Perquisites: Non-cash benefits that employees receive from their employers in addition to their regular salary.

Capital Gains: The profit earned from the sale of shares or any other capital asset.

Tax Deducted at Source (TDS): The means by which the Indian government collects tax at the point of generation of income.

Check out our Perquisite Tax Calculator and see how it can simplify your ESOP taxation calculations. Be it understanding the amount of tax you owe on your ESOP perquisites or planning your finances better, this tool is designed to make your life easier. Make the most of it today and let us help you navigate the world of ESOPs and taxation effortlessly.